I attended the 2018 Minneapolis/St. Paul Commercial Real Estate Valuation and Appraisal Forecast Summit held at the Golden Valley Country Club on Friday, January 19, 2018. Topics centered on valuation trends for the retail, industrial, office and multi-family property sectors. This article looks back on some trends from 2017 and expectations in 2018.

My Top Takeaways for the Four Property Types

Retail – Contrary to headlines, brick-and-mortar retail is not dead. Rather, realize retail is changing, some brands are dying and new brands are replacing them. Overall, retail is performing fine.

Industrial – According to CBRE, the Minneapolis/St. Paul industrial market has had 30 straight quarters of positive absorption. While this is a longer positive run than normal, and historically, we tend to see market corrections, current signs and trends point to continued strong industrial demand.

Office – The office market saw record high per square foot sale prices in 2017 for CBD and suburban multi-tenant office buildings. Two examples include Fifty South Sixth in the Minneapolis CBD selling for $370/SF and The Colonnade, a suburban property in Golden Valley sold for $281/SF. This also points to the continued bifurcation of rental rates as some Class A rents are approaching levels that are causing tenants to retreat to Class B options or different submarkets.

Multi-Family – Strong market fundamentals supported by job growth and lifestyle choices among baby boomers and millennials provide a continued sense of optimism in multifamily. While many would agree we are at a current high peak, next year will mostly likely be a higher peak because of strong fundamentals.

Retail Market

If you only study the headlines, one could quickly begin to think, is brick and mortar retail dying? The short answer is NO! Rather, retail is changing, some old brands are dying and new brands are stepping in to replace them. One reality with the changing market dynamics is the economic life of most retail properties is shortening. While online shopping has certainly had an impact, think of an older brand like Sears/Kmart. The audience of about 200-300 was asked who had shopped there during the holiday season. There were probably fewer than 10 participants who shopped at these stores. Despite store closures in the Twin Cities, a lot of space is getting backfilled.

Another example of changing retail trends is the recent January 2018 announcement by Sam’s Club to close about 63 stores across the country. With 597 locations, this is a 10.6% reduction in store count. However, about 10 to 12 of the properties will be converted to distribution centers. The company attributes this decision to the need to better fulfill online orders, less population growth than expected in some markets and too many competing locations. Thus, it’s an example of right-sizing and adapting to changing market forces.

There has also been talk about the future of some regional malls. Attention local cities! Are you looking to increase your tax base? Look at parking fields around the larger malls and reconsider the current parking ratio requirements. Perhaps these can be modified and additional value can be unlocked.

In many instances, developers and property owners are working to reposition these assets and taking advantage of substantial parking lot space to increase density and unlock the value of the underlying real estate. A great example is the Southdale Center in Edina. Working to expand the live/work/play model and capitalize on excess parking areas, additions include a 146-room Homewood Suites by Hilton and Lifetime Fitness replacing JC Penney, One Southdale Place, a luxury apartment complex and additional retail.

Overall, the 1031 tax exchange market continues to perform at a healthy pace. In 2017, the bid-ask spreads widened a bit so deal flow slowed a bit. With new tax laws that take effect in 2018, it brings certainty to buyers. One trend investors are seeking is Amazon proof stores. An example would be coffee shops – it’s hard to get hot coffee delivered to your door.

Location, location, location…. retailers will pay premium rents for a great location. However, as an investor or underwriting retail property, it’s important to understand the rent to sales ratio of a particular location to gauge the long-term viability of the tenant. Healthy ratios or total cost of occupancy/gross sales can vary among retail tenants from 5%-20%. Healthy rent-to-sales ratios are vital for tenants to maintain profitability. Rents that are too high to support sales for the location greatly increase the risk in tenants vacating, struggling or restructuring the lease term upon renewal to a lower rate.

Multi-tenant retail centers are performing well. Cost of construction is up, partly due to higher standard of building design requirements among cities and tenants. Most tenants seem to be doing well and business is up for most service tenants. Smaller, multi-tenant strip centers have been selling to 1031 buyers, but are dependent on tenant mix. In recent years, buyers are more sophisticated and knowledgeable and spend more time understanding the properties and tenants.

Daycare centers are in high demand with some cap rates lower than Walgreens transactions. In the acquisition of these properties, it’s important to understand if the demographics of the area will support daycare use over the long term.

National brand auto repair property type cap rates are often less than 6.0%. Strong demand exists. Longer term, it will be important to keep an eye on the evolution of autonomous vehicles as that could impact demand.

For strong credit, triple net tenants, cap rates are about 5.0% to 6.0% and about 6.0% to 7.0% for moderate credit tenants. Some grocery anchored center cap rates dipped below 6.0%. Multi-tenant retail centers cap rates tend to be slightly higher in the range of about 6.0% to 8.5%. Class C properties, particularly in outstate MN exhibit a wide cap rate range and can approach 10% or higher. Of course, each deal is underwritten separately and heavily dependent on the location, building quality, tenant mix and lease term.

Industrial Market

According to CBRE Q42017 Industrial Marketview, Minneapolis/St. Paul industrial market has had 30 straight quarters of positive absorption. While this is a longer positive run than normal, and historically, we tend to see market corrections, most market participants opine and current trends point to continued strong industrial demand.

With positive absorption, industrial development continues. In the fourth quarter alone, 10 new buildings were completed that added about 1.3 million square feet to the market. This included five build-to-suit projects and five spec completions approaching 1.0 million SF. The spec buildings were about 68% leased at completion. CBRE reports current vacancy as of Q4 2017 at 4.2%.

Significant demand exists for new, modern and updated buildings. With continued need to achieve last mile distribution centers, the brokers on the panel stated opportunity exists to convert smaller, older buildings with lower clear heights to meet that need. They are also seeing some of these buildings being converted to office use.

As the Southwest Light Rail Transit (SWLRT) project continues to move forward, this is forcing some industrial users to prepare for relocation. Cities along this corridor include Minneapolis, St. Louis Park, Hopkins, Minnetonka, and Eden Prairie. Smaller, owner user buildings are in high demand and buildings that stay on the market longer tend to have some level of functional obsolescence. For those needing to relocate, the challenge is finding replacement properties, especially with limited supply and strong pricing.

With low unemployment across the Minneapolis/St. Paul metropolitan area, employers report increasing difficulty finding employees for standard manufacturing/industrial type jobs. As a result, industrial employers are looking for location and building amenities to create attractive work environments to capture better labor.

Where are market rents for industrial properties? The general rule of thumb of $8.00/SF for office and $4.00/SF for warehouse may apply for older office/warehouse space, but newer construction buildings are achieving higher rents. On some buildings, rents are $10.00 – $12.00/SF for office and $5.00/SF for warehouse. Some of the higher lease rates are due to construction costs and higher levels of finish. At present time, new users are getting more comfortable with longer lease terms of seven to years. This compares to several years ago when three to five year terms were the norm. This is likely a combination of market availability and confidence in fundamentals. Landlords seem more willing to amortize tenant improvements.

Where are capitalization rates?

- Industrial – High quality, new industrial investment grade have seen cap rates in the 6.0%-6.75% range. More coastal buyers are looking at opportunities in the Twin Cities due to higher rates of return that can be achieved.

- Good quality, owner user oriented buildings in Minneapolis/St. Paul are about 7.0% – 8.0%. Extending to fringe and beyond, cap rates exceed 8% and upwards of 9.0%.

Office Market

The Minneapolis/St. Paul office market saw record high per square foot sale prices in 2017 for CBD and suburban multi-tenant office buildings. Two examples include Fifty South Sixth in the Minneapolis CBD selling for $370/SF and The Colonnade, a suburban property in Golden Valley sold for $281/SF. The buyer of the Fifty South Sixth property was Singapore based investor Mapletree. As pointed out by JLL, several Minneapolis CBD trophy assets have attracted global capital from China, Germany, Canada, Israel, the Mideast, and now Singapore.

In downtown Minneapolis, office vacancy is about 17%. Still dealing with excess space as Wells Fargo moved from multi-tenant space to their Downtown East headquarters, the North Star office building is in foreclosure. According to CBRE, the average metro vacancy rate dipped below the 10-year average of 16.8% to 16.3% in Q4 2017.

In the suburbs, tenants are running into rent fatigue with rents at the high end of the Class A market. Examples of this occurring are primarily in the West submarket along I-394. Combined with high operating expenses, the elevated gross rents are causing tenants to look for alternative options. The net rent spread in the West submarket for Class A and Class B space is about $5.00/SF and jumps to $8.00-$10.00/SF after including operating expenses.

This widening spread has some tenants looking at Class B options or different submarkets. With higher vacancy rates, the Southwest Class A office market rents are closer to West Class B office rents. As a result, brokers are seeing more success in leasing renovated Class B space.

The North Loop area remains a strong submarket with the expectation the area will see a few more value-add deals done in 2018.

Many tenants that renew space today are reducing their footprint while maintaining similar employee counts. The downsizing trend includes law firms, accounting firms, ad agencies, etc. This is creating pressure on parking ratios as office tenants are pushing for lower space per employee averages. Sometimes, the increased parking requirements are difficult to achieve.

At present time, there is little to no new speculative office development. The primary reason being rents are not sufficient to support new construction costs. Furthermore, shadow space is created as tenants continue to downsize and this keeps vacancy rates elevated.

Some of the historical co-working space providers such as Regus offer varying monthly lease rates for tenants depending on usage of on-site amenities such as secretarial services, food, etc. A few of the newer entrants to the market such as WeWork, Industrious, etc. are competing in the co-working space by offering smaller tenants an option to pay a fixed rental rate, but at a premium for the additional suite amenities.

The investment office sales market shows continued strong activity with about $750 million under contract and scheduled to close by end of February 2018. Cap rates for Class A, CBD buildings are sub 7.0%, smaller, above average buildings in the metro are in the range of 7.0% – 8.0% and about 8.0% -9.0% for older or fringe type locations.

Multifamily Market

Strong market fundamentals supported by job growth and lifestyle choices among baby boomers and millennials provide a continued sense of optimism in multifamily. While many would agree we are at a current high peak, 2018 will mostly likely be a higher peak because of the strong fundamentals.

One trend that has continued over the past 12 months is the appeal of value-add apartments. As new Class A building have been built with extensive amenities, a wide rent spread remains when comparing top Class A units to Class B/C units. This creates two multi-family markets, those who want and can afford Class A units and those who cannot afford or don’t want to pay the higher rents and settle for Class B and C units.

Another opportunity in Class B and C apartments is the implementation of RUBS, a utility billing method that allocates 100% of your property’s utility bill to the residents based on an occupant factor, square footage or a combination of both, less a predetermined percentage (determined by the owner) of a common area allowance. While historically offered in higher end apartments, owners have reported success with adding this option to lower quality properties.

To help combat the continued strong market activity of investors buying value-add properties with plans to renovate and increase rents, some non-profits have stepped in and bought apartments they view as naturally affordable. One example is when affordable housing owner and developer Aeon paid $36 million or $85,308 per unit in September 2017 for a 422-unit Richfield apartment complex it intends to preserve as workforce housing.

Construction costs are rising and finding construction labor is impacting projects, particularly delivery times. Payroll and maintenance expenses are higher with the current low unemployment. Some landlords are more challenged with finding adequate maintenance staff for mechanical repairs, etc. While dependent on the property size and number of units owned, one way to potentially offset this is centralizing repairs and maintenance staff across a portfolio instead of having maintenance staff at each individual property.

Real estate taxes are increasing with higher property values, but strong market sales data make it more difficult to argue for keeping taxes lower. As investors, particularly out-of-state buyers, it remains important to properly account for stabilized taxes in the pro-forma projections.

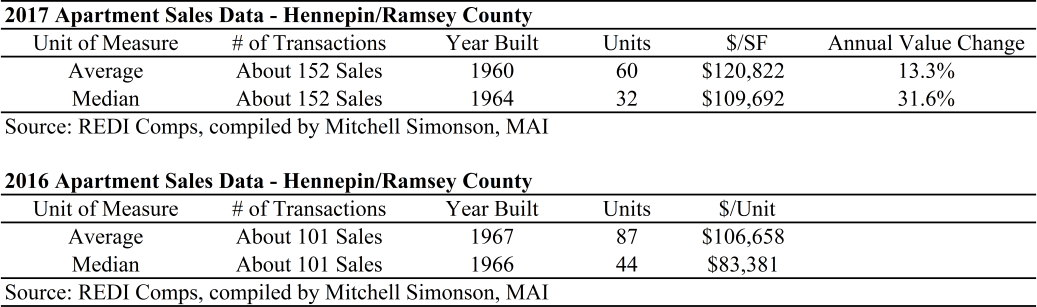

The value trend in 2017 was the same as previous years. Rent growth and low market vacancy led to strong value increases. The following market data compiled from REDI Comps shows value trends for 12-unit or larger apartment sales in Hennepin and Ramsey counties for 2016 and 2017.

Based on the available data, 2017 had about 51 more transactions and the average sale price increased 13.3%. The median sale price showed an increase of 31.6%. One notable difference for 2017 compared to 2016 is there were several larger, newer Class A apartment sales. This factor, coupled with the strong market fundamentals significantly pushed up the average and median sale price for apartment properties in Hennepin and Ramsey County.

One recent market example that supports this significant value appreciation is the 500-unit Park Place Apartments in Plymouth, MN that last sold in September 2017. While important to note renovations were made between each sale date which upward influenced the sale prices, the following appreciation is revealed.

- 9/2017 – $92.3 million – up 19.9% in 11 months

- 10/2016 – $77 million – up 40.8% in about 5 years

- $54.7 million – 2011 sale price

According to Colliers International Minneapolis/St. Paul Multi-Family Year-End 2017 report, “2015 set records with the highest total sales volume in Twin Cities history, hitting the $1 Billion mark which is almost double the historical average. In 2016, total sales volume surpassed $1.5 Billion and is currently on pace to exceed that figure and approach $2 Billion.”

Historically, annual sales volume of $500 to $750 million was the norm. This was largely driven by the fact the market was dominated by local investors who had long term buy and hold strategies. In recent years, the market has attracted national investors due to the desirable market fundamentals and strong, diversified economy. National investors tend to have shorter holding periods and focus on maximizing returns. As more national investors place the Minneapolis/St. Paul market on their radar and with shorter holding periods, higher sales volume seems probable.

While dependent on building quality, occupancy and location, cap rates for urban core Class A apartments have been in the approximate range of 4.5% to 5.0% and 5.0% to 5.5% for suburban Class A product. Recent treasury rate increases has tightened the spread on cap rates, but it’s expected longer term financing options will help keep cap rates at current levels. Cap rates for stabilized Class B properties range from about 5.5% to 6.25%. Finally, cap rates for Class C properties saw even more compression and are about 6.0% to 6.75%, with some dipping below 6%, depending on value-add opportunity.

My final thought – As I write this in January 2018, one consistent theme persists among the four property types in the Minneapolis/St. Paul – record highs. Strong rent growth and peak pricing for multi-family, record high office sale prices, record long positive absorption run for the industrial market, construction costs continue to rise and retail rents for select locations continue to escalate. On the stock market side, the Dow Jones Industrial Average, S&P 500 and Nasdaq Composite have risen to all-time record highs.

Most market participants express continued optimism as market fundamentals appear solid. If we look at history as any indication of future performance, one should at least be aware of the fact we are in a period of record highs. Assuming no particular shock hits the system in 2018, it seems most believe the record highs will continue. Nonetheless, it’s good to consider this when making investment decisions of any type.

Mitchell Simonson, MAI is an expert commercial real estate appraiser and investor. Since 2005, Mitchell has appraised hundreds of commercial real estate properties across many property types.

Real estate is a great vehicle to create long-term wealth! He speaks, consults and trains on Helping Lenders, Brokers and Investors Navigate the Appraisal Process and to ensure his clients are making wise commercial real estate investment and underwriting decisions to help them meet those goals.

To inquire about booking Mitchell for consulting or appear at your next conference or event, please email mitch@simonsonap.com or call at 612-618-3726.